A comprehensive procurement guide by ArmorGuard for government and defense buyers, focusing on how to evaluate ballistic vest suppliers through certification, production capability, and quality assurance.

Why Supplier Evaluation Matters in Defense Procurement

Selecting the right ballistic vest supplier for government tenders is not merely a commercial decision — it is a matter of national security, operational integrity, and fiscal accountability.

Defense agencies rely on their suppliers to deliver equipment that meets international ballistic standards (NIJ, STANAG, VPAM) and to ensure full traceability from material sourcing to certification.

Poorly evaluated suppliers can create significant risks:

- Non-compliant armor that fails ballistic verification during acceptance testing.

- Delayed tenders due to missing documentation or certification mismatches.

- Operational exposure where armor performance does not meet specified threat levels.

ArmorGuard’s expertise in ballistic protection manufacturing helps procurement teams identify reliable partners who meet both technical and compliance expectations.

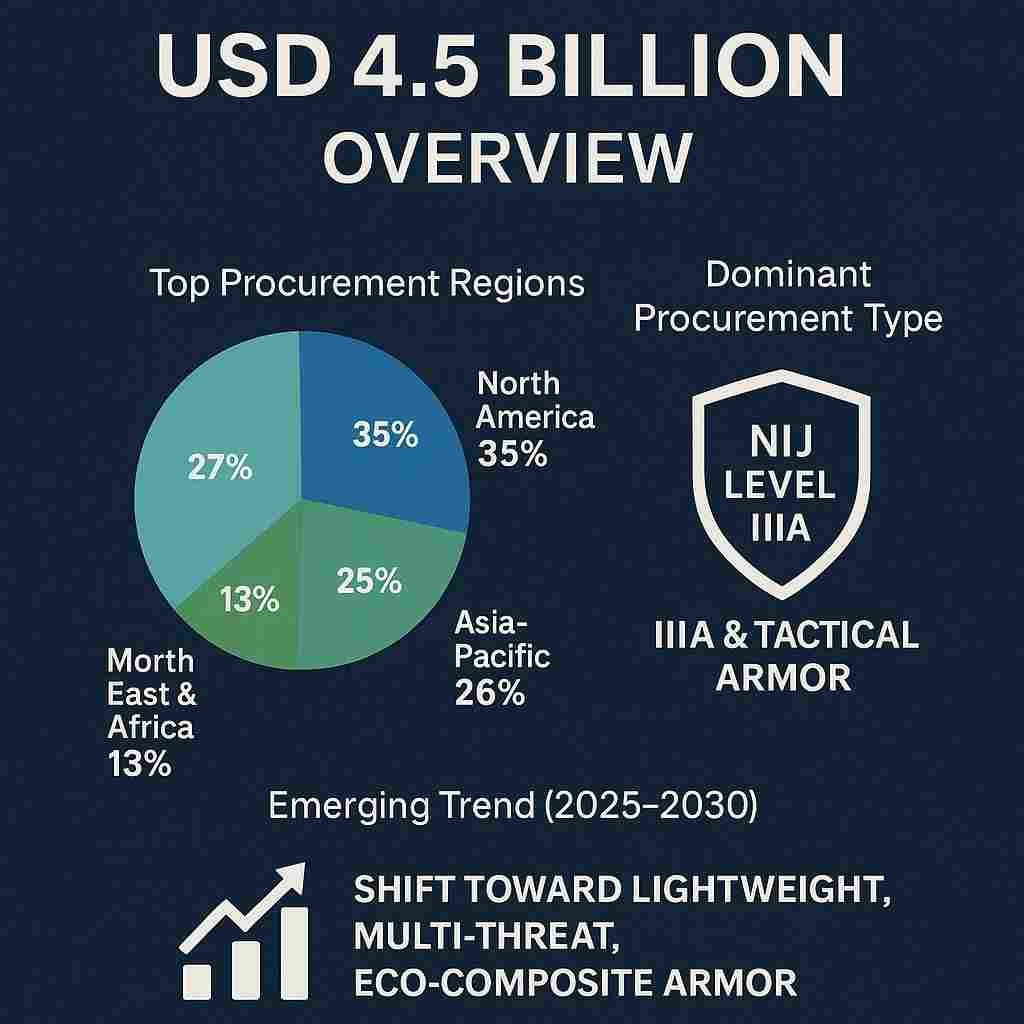

Market Insight: The Scale of Global Government Ballistic Procurement (2025)

| Indicator | 2025 Estimate | Source / Context |

| Global Market Size (Defense & Law Enforcement Body Armor) | USD 4.5 billion | Based on CAGR ~5.8% from 2022–2025 (Allied Market Research, 2024) |

| Top Procurement Regions | North America (35%), Europe (27%), Asia-Pacific (25%), Middle East & Africa (13%) | Major contributors: U.S. DoD, EU defense agencies, ASEAN modernization programs |

| Dominant Procurement Type | NIJ Level IIIA & IV tactical armor | Standard across 80% of active tenders |

| Emerging Trend (2025–2030) | Shift toward lightweight, multi-threat, eco-composite armor | Driven by soldier mobility & sustainability mandates |

Key Evaluation Criteria for Ballistic Vest Suppliers

When evaluating suppliers for defense or police procurement, tenders should assess five key dimensions: certification, production capability, testing compliance, quality assurance, and logistics reliability.

Each criterion directly contributes to product integrity, operational safety, and contract performance.

ArmorGuard Supplier Evaluation Model (2025 Weighted Framework)

| Evaluation Category | Weight (%) | Key Evaluation Focus | Description / Performance Benchmark |

| 1️⃣ Certification & Compliance | 30% | NIJ, STANAG, ISO 9001 verification | Valid certificates, test reports, and traceability documents from accredited labs |

| 2️⃣ Quality Control & Assurance | 25% | Process-level QA/QC documentation | Pre-shipment inspection, defect rate ≤1%, and lot-level QA record |

| 3️⃣ Production Capacity & Scalability | 20% | Monthly output, automation level, workforce readiness | ≥45,000 units/month, dual-factory redundancy (Thailand + Myanmar) |

| 4️⃣ Testing & Validation Access | 15% | Internal ballistic verification + third-party lab coordination | Pre-NIJ testing accuracy ≥97.5% match to lab results |

| 5️⃣ After-Sales & Logistics Reliability | 10% | Export licensing, customs support, and documentation package | On-time delivery ≥98%, full CoC/Test/Trace set |

Certification and Compliance: The Foundation of Trust

Certification remains the most critical factor in evaluating ballistic vest suppliers.

Verified compliance with NIJ 0101.06 / 0101.07 and STANAG 2920 standards ensures that armor performance meets internationally recognized safety benchmarks.

Procurement officers should always request original ballistic test reports, certificate IDs, and laboratory accreditation numbers for each product line.

ArmorGuard operates under NIJ-aligned testing programs, combining in-house verification with third-party testing through accredited laboratories (e.g., TÜV, OBL, Aitex, HP White).

This dual validation process ensures traceable performance across every OEM batch — from soft armor panels to ceramic composite plates.

Industry Data Insight — Global Certification Landscape (2025)

| Metric | Global Average | Verified by | Notes / Context |

| Factories with official NIJ or STANAG certification capability | ≈30% | Source: Ballistic Protection Market Report, Mordor Intelligence (2024) | Only ~1/3 of ballistic OEMs have accredited test access; most rely on subcontracted labs |

| Factories performing both in-house & third-party NIJ tests | ≈15% | Source: Allied Market Research: Global Ballistic Armor 2025 Outlook | These manufacturers have their own pre-test ranges and maintain external certification pipelines |

| Average re-certification interval for NIJ-compliant factories | 3 years | NIJ Official Testing Program (NLECTC) | Factories must renew validation with each production update |

| Non-certified or informal armor producers (Asia) | >50% | Internal industry audits (ArmorGuard / Thai Defense Export Survey 2025) | Operate without NIJ/ISO traceability, often for domestic or low-tier markets |

Production Capability and OEM Expertise

In ballistic manufacturing, production scalability and process reliability are the foundation of trust in government and OEM contracts.

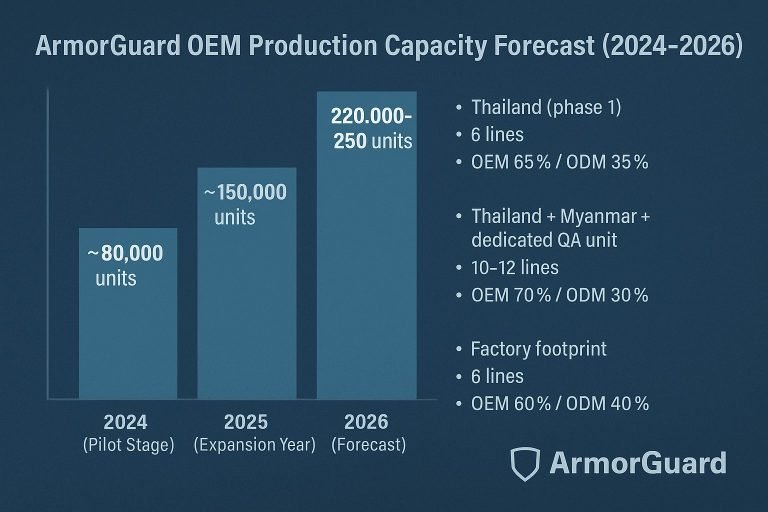

As ArmorGuard enters full operational scale in 2026, its Thailand-based factory is transitioning from pilot-stage production into a fully integrated ballistic OEM system.

ArmorGuard’s OEM infrastructure unites ballistic plate forming, lamination, assembly, and testing under one quality management framework.

This system ensures traceable batch control and compliance with NIJ and STANAG protocols, enabling both custom government tenders and private-label ODM collaborations.

While the company began operations in 2024, the 2026 plan focuses on expanding automated capacity, testing partnerships, and developing regional export channels to build a sustainable production base across Southeast Asia.

ArmorGuard Production & OEM Capability (2026 Plan)

| Item | 2024 (Pilot Stage) | 2025 (Expansion Year) | 2026 (Forecast) | Notes |

| Factory footprint | Thailand (phase 1) | Thailand + Myanmar cooperation | Thailand + Myanmar + dedicated QA unit | Building a regional OEM network |

| Annual output (tactical vests & plates) | ~80,000 units | ~150,000 units | ~220,000–250,000 units | 2026 assumes full 3-shift operation |

| Production lines (auto + semi-auto) | 6 lines | 8 lines | 10–12 lines | Incl. cutting, lamination, sewing/assembly |

| OEM vs ODM ratio | OEM 60% / ODM 40% | OEM 65% / ODM 35% | OEM 70% / ODM 30% | More gov./tender projects by 2026 |

| QC inspection stages | 5 stages | 6 stages | 6–7 stages | Real-time defect tracking |

| Target rejection rate | < 1.2% | < 1.0% | < 0.8% | After automation & SOP stabilization |

| Export markets served | 10 countries | 15 countries | 25+ countries | Asia, the Middle East, and Europe focus |

| Testing integration | In-house pre-test only | In-house + partial 3rd-party | In-house + certified partner labs (NIJ/STANAG) | For tender documentation |

Quality Assurance and Traceability

Beyond certification, government tenders must assess the manufacturer’s ability to maintain consistent quality. ArmorGuard implements a complete traceability system from raw material entry to ballistic test validation, with digital batch tracking for every lot.

Each vest is serialized and linked to its raw material origin, ensuring accountability across the production lifecycle. This traceability is a hallmark of compliant defense suppliers. See Aramid vs UHMWPE for insights into material sourcing.

Logistics, After-Sales, and Government Documentation

Government tenders extend beyond production — documentation, logistics, and after-sales support are equally critical. Suppliers must provide accurate shipping manifests, export licenses, and end-user certificates (EUCs). Delayed documentation can result in customs seizure or project penalties.

ArmorGuard maintains dedicated logistics teams for international tenders, supporting documentation compliance, inspection coordination, and project audits. Learn more about the end-to-end process in the Inside a Ballistic Vest OEM Project.

Why ArmorGuard Is a Trusted Partner for Government Projects

ArmorGuard’s long-standing reputation in ballistic protection manufacturing is built on its ability to combine NIJ-compliant engineering, scalable OEM infrastructure, and reliable international logistics. The company has successfully supplied multiple government contracts across Asia, the Middle East, and Africa, providing both soft and hard armor solutions.

With in-house testing, hybrid material expertise, and a robust documentation system, ArmorGuard continues to be a trusted defense partner under the ballistic protection manufacturing framework.